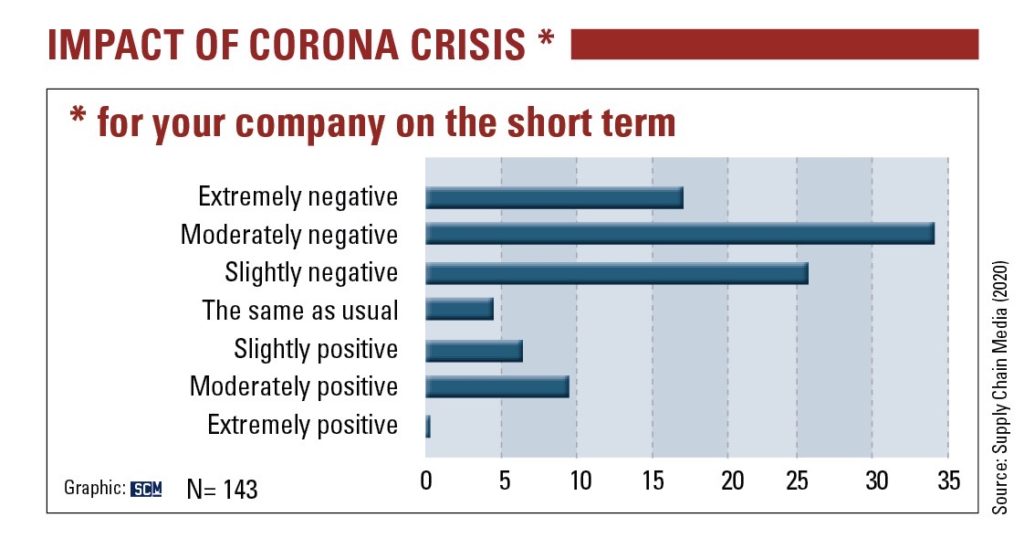

Three-quarters of European supply chains are negatively impacted by coronavirus

The coronavirus pandemic is having a clear impact on the supply chains of virtually all European manufacturers, wholesalers and retailers. Although 78% of them are experiencing a negative short-term impact, 17% are noticing positive effects. Only 5% say they are not affected in any way. These findings come from a survey by Supply Chain Media among 143 supply chain decision-makers in Europe. The respondents are directors and managers from the whole spectrum of industries that produce and trade physical goods, and they all have European or even global supply chain responsibility.

By Martijn Lofvers

The 143 respondents completed Supply Chain Media’s online survey in the last week of March, which was an extremely hectic period for their supply chains. The short survey consisted of a series of questions about how they were assessing the situation, the bottlenecks identified, the changes in supply and demand, the action taken and the ultimate impact on their company. Responses from numerous supply chain executives confirmed that such a survey – in the heat of the moment – is very valuable to gain insights into how other companies are reacting.

Various checks

Among the European companies surveyed, their actions to assess the situation were mainly focused on the operational level. Of the checks carried out, risk analysis of their own operations (production, warehouse and transport) scored the highest with 94%. Meanwhile, 85% of all respondents examined the operational risk of the incoming flow of raw materials and parts, and 76% of the outgoing flow of products (deliveries).

On a tactical level, 81% of companies looked at how much capacity their strategic suppliers had available and 77% explored different scenarios to keep supply and demand aligned. According to one European supply chain director at an ingredients manufacturer, he had been called by almost all his customers asking about stock availability and production capacity. Executives with global supply chain responsibility are paying more attention to the financial health of strategic suppliers than their peers with European responsibility only.

Bottlenecks in supply chains

According to the respondents, the most important supply chain bottlenecks during the coronavirus crisis are inbound flows of goods from suppliers (62%), lack of insight into customer demand (60%) and outbound shipments to customers (50%). Lack of demand visibility scored the highest among manufacturers of consumer goods, with 70%. In business-to-business, three quarters of companies regard the supply of raw materials and parts as the biggest bottleneck.

Changes in customer demand have been very variable since the start of the coronavirus outbreak in China. 58% of respondents have seen some degree of decreased demand, while 30% have experienced an increase. Extreme decreases and increases in demand have mainly been experienced in consumer goods. Most companies are seeing a clear decline on the supply side in terms of numbers and volume, especially in the supply of raw materials and components (59% of respondents). The supply side remains stable for just over a quarter of respondents.

Acute action

The survey asked the respondents what action they have taken in response to the coronavirus crisis. Three quarters of the European companies have implemented health measures in warehouses to prevent the internal spread of the COVID-19 virus. The next most common action has been to place additional orders with suppliers (63% of the companies). Almost 60% have accelerated their strategic planning cycle (Sales & Operations Planning) from monthly to weekly or even daily. 37% have temporarily shut down their factories to ensure that employees can work more safely, such as confectionery manufacturer Mars which has closed the world’s largest chocolate factory in the Dutch town of Veghel.

Shortening or extending the payment terms scored low (just 10% and 17% respectively). Unilever is one of the positive exceptions; the company has announced it will pay invoices from its small and medium-sized strategic suppliers as soon as possible from now on, and will also be financing its small retail customers, especially in fast-growing economies.