SCM survey: Software for end-to-end visibility in great demand

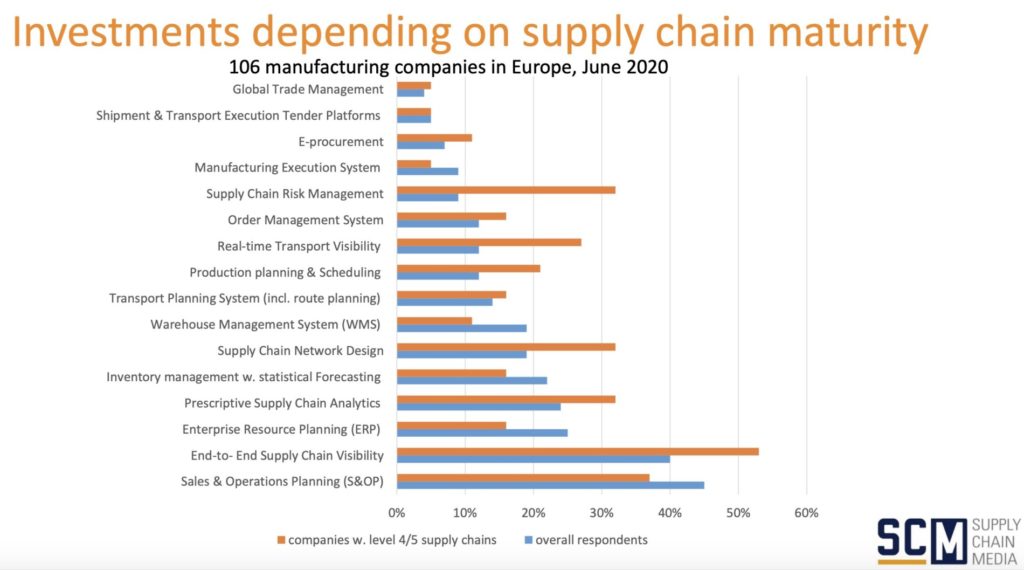

Over the next 12 months, European supply chain software implementations will be mainly focused on sales & operations planning (S&OP) and end-to-end supply chain visibility. The plans to invest in a particular type of supply chain software vary per company, depending on the level of supply chain maturity and the competitive strategy. A total of 106 European supply chain directors and managers from the worlds of manufacturing, wholesale and retail took part in Supply Chain Media’s SCM Software Survey in May.

By Martijn Lofvers

In order to gain a clear picture of the current state of play in Europe, the respondents were first asked which megatrend will have a significant long-term impact on their business. Digitalization was ranked the most important megatrend by 70% of respondents, followed by sustainability in second place with 46%. Globalization and pandemics were also mentioned as decisive megatrends by 40% and 38% respectively. Many of the companies that regard the coronavirus crisis as a megatrend also named sustainability.

Impact of the coronavirus crisis

The coronavirus crisis is clearly influencing European companies’ plans to invest in supply chain software. In particular, the peaks and troughs in customer demand and production capacity experienced around the world at the height of the COVID-19 outbreak earlier this year have stimulated the need for software to support S&OP and end-to-end supply chain visibility. Around a quarter of the respondents intend to invest in enterprise resource planning (ERP) and prescriptive supply chain analytics. The companies planning to invest in analytics tend to have an above-average level of supply chain maturity, whereas the less mature companies are much more likely to implement ERP and warehouse management software.

The huge need for visibility is undoubtedly due to the unpredictability of international supply chains caused by the coronavirus crisis. Despite this, real-time transport visibility – a fairly new type of software – scored relatively low with just 12%. Having said that, 27% of companies with an above-average level of supply chain maturity intend to invest in it, and 5 out of the 10 logistics service providers surveyed separately expressed plans to implement such software in the coming year.

This study reveals that not only a company’s supply chain maturity but also its competitive strategy – Operational Excellence, Product Leadership or Customer Intimacy – heavily influences the investment plans. For example, a relatively higher number of companies following an Operational Excellence strategy to minimize costs plan to invest in order management than in network design and S&OP.

Information about software

When selecting supply chain software, input from colleagues is the most important source of information, according to 55% of the respondents. In second and third place are insights from analysts such as Gartner and from specialized supply chain consultancy firms, with 39% and 38% respectively. A third of the respondents obtain advice from non-specialized consultancy firms, and just 15% contact system integrators such as Capgemini.

Looking for Supply Chain Software? Make sure you check the interactive subway map!