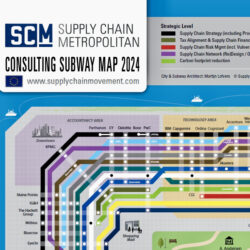

SCM Consulting Subway Map 2024

Due to the numerous extreme economic and geopolitical challenges in the world, there remains a strong need for supply chain consultancy, especially in the areas of Sales & Operations Planning (S&OP), strategy and network design. But the financial picture of the diverse consulting firms in the European arena varies considerably: from growth to under considerable pressure. These are the main observations from the annual survey for the SCM Consulting Subway Map of Europe.

The need for supply chain consultancy among companies in Europe remained high in 2023. Last year, 72% of the 32 consulting firms surveyed realized more supply chain projects compared to 2022. This growth rate in realized projects is lower than in 2020 and in 2021, with 95% and 86% respectively.

In terms of profitability, there was indeed a turnaround compared to previous years. In 2022, 83% of the consulting firms surveyed saw profits increase, whereas last year this percentage fell to 53% and 19% even saw a decrease. Especially the big, well-known strategy consulting firms, such as McKinsey, BCG, Bain and Roland Berger, struggled in 2023 and had to accept a fall in profits, introduce a vacancy freeze and sometimes lay off employees. These disappointing results apply to a lesser extent to the four majour consulting firms with an accounting arm: Deloitte, EY, KPMG and PwC.

S&OP, IBP and digital twins

The ongoing war in Ukraine and more recently in the Gaza Strip have led to extreme geopolitical tensions. One clear consequence are the trends of (partial) reshoring of production from China to Europe and Mexico, and more regional distribution and logistics. These trends lead to a continued need for network studies and scenario analysis of international logistics flows by specialized consultancies such as Buck Consultants International, Diagma, Districon, Logivations and Scope8 (formerly Visagio).

In terms of the most implemented projects, networks studies as well as consultancy on supply chain strategy and product portfolio shared second place, both with 53%, behind S&OP which once again topped the list with 59%.

Get the SCM Consulting Subway Map 2024

For the 11th edition of the SCM Consulting Subway Map of Europe, the editors relied on information provided by the consulting firms themselves. A combination on the number of consulting projects completed, the market share in turnover for each specific area of consultancy, the size of the company and the degree of specialization determines whether a company gets its own subway station on the relevant line, visualizing its proven expertise.

The poster is available to everybody in the webshop of Supply Chain Media >>