Mindmap of the Direct-to-Consumer Supply Chain

Consumer behaviour is constantly changing. Increasingly, we see consumers taking out subscriptions: to save time or money, for convenience, or as a form of financing. For companies in the Consumer Packaged Goods (CPG) sector, this offers a promising playing field to connect directly with the end customer and be less dependent on ever larger retailers. However, successfully offering subscriptions poses significant challenges that are new to these companies. SCM, together with IG&H, market leader in complex, end-to-end, digital transformations in the retail and CPG sectors, has created this mindmap to help FMCG and CPG companies on their way to launch distinctive customer propositions.

Mindmap manual

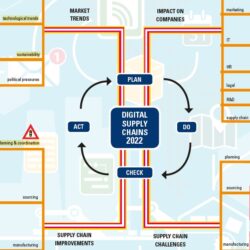

Megatrends – Subscriptions are playing an increasingly prominent role. Our society is moving towards a service economy, in which convenience, flexibility and sustainability are key. We see the emergence of a new digital generation that attaches less importance to possessions, is increasingly demanding and individualistic, and is less brand loyal. Rising inflation is another reason why customers are increasingly rethinking their traditional ways of buying. At the same time, the growing range of digital platforms, an abundance of data and smart devices are facilitating the supply and management of subscriptions.

Impact – The growth of subscriptions means that CPG companies themselves can engage directly with end consumers through a longterm relationship. Central to this is the direct-to-consumer (D2C) channel as a platform for various distinctive customer propositions. The focus broadens from just B2B transactions to B2C relationships. CPG companies themselves now have to continuously convince consumers of the added value of their products and services. A direct customer channel also means that products and packaging have to be adapted, e.g. to enable home delivery. Lastly, there are choices to be made in terms of pricing and channel strategies, and new complexities arise in terms of the financial aspects.

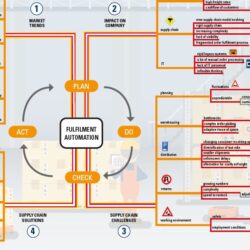

Challenges – In the past, CPG companies produced large batches for their retail and wholesale customers as efficiently as possible, mainly to order. For the D2C channel, products need to be available all the time. Combining B2B and B2C delivery is a transformation in itself for most companies. The number of orders grows significantly, packaging and shipping methods are different, and home delivery has a big impact on the customer’s perception of service. The return flow also needs to be in order, both from a customer journey perspective and from an operational and IT perspective. All this makes demand planning and supply planning much more complex, and CPG companies’ original data and IT systems are rarely fit for the purpose.

Solutions – CPG companies can learn a lot from retailers in terms of D2C. Supply chain activities need to be organized around the customer, which requires more flexible production and clear choices regarding the last mile. Shipping software is needed for satisfactory service, and also gives companies insight into their own performance. Investing in E2E supply chain planning makes real-time information available as the basis for making key decisions. Ultimately, companies can determine their strategy in a more informed way by combining supply chain insights with customer insights and financial performance.

Find more mindmaps of Supply Chain Movement here >>