Choosing supply chain software: Audi or Tesla?

The new SCM IT Subway Map shows just how large and complex the supply chain software market is. How can you choose the right solution from the range of names – both established and new ones? Should you opt for a classic, reliable Audi A6, or should you take a gamble and invest in a Tesla? Supply Chain Media’s Martijn Lofvers and Involvation’s Hans van der Drift provided some tips in a recent webinar.

By Marcel te Lindert

Sales & operations planning (S&OP) software is still high on the wish list of supply chain professionals, but the selection process for that software has changed. According to Hans van der Drift, it has become easier. “There’s only a very small chance of making the wrong choice these days, because all software vendors now deliver the same basic functionality needed to support the S&OP process. You can compare it to buying a car. An Audi A6 is a classic, reliable car with a great track record and a design based on proven technology. Anyone who chooses it is making a safe choice,” said Van der Drift, who in his role as consultant frequently helps companies to select S&OP software.

Disruptive technologies

From another perspective, however, the selection process has also become more complex due to the rapid technological developments that are causing upheaval in the market. Again, Van der Drift likened it to the automotive industry: “We see this happening in the car market as well. New players are emerging, with Tesla at the forefront, who are gaining a foothold and drastically changing the way we drive. Their cars still have four wheels and a steering wheel, but also have new, potentially disruptive technologies on board. People who continue to choose an Audi A6 will have to live without those technologies. But people who choose a Tesla risk being too quick to adopt technologies that later turn out to be insufficiently mature. A similar kind of thing is starting to happen in the S&OP software market.”

Martijn Lofvers cited Lora Cecere, influencer and founder of Supply Chain Insights, who has also used the car as a metaphor for S&OP software. “She advises companies not to get bogged down in lists of selection criteria, but to take a quick test drive by asking software vendors to give a live demonstration. Another issue is whether one car is enough. Perhaps you need a complete fleet comprising a large diesel truck, a small electric truck and a forklift. The question is whether you should order the entire fleet from the same supplier or select the best supplier for each type of vehicle,” said Supply Chain Media’s chief trendwatcher.

Get the basics right first

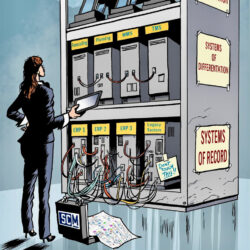

In the webinar on supply chain software selection, Lofvers also explained the latest SCM IT Subway Map. It makes it clear that there are various types of software on the market, including for S&OP. Every company needs the basics: the systems of record which support transactions and register orders. The layer above that consists of the systems of differentiation, which companies use to set themselves apart, e.g. in terms of planning and forecasting. “The top layer consists of the systems of innovation: applications that make use of machine learning and cognitive automation, for example, or the apps that companies can simply plug in,” continued Lofvers.

This layered approach underscores the importance of a good, solid foundation before companies can think about implementing innovative solutions. After all, those solutions have to be fed with the data that largely comes from the systems of record. “Additionally, this approach shows that companies don’t have to stick with a single IT environment based on SAP or Oracle applications. It can be a legitimate choice to opt for best-of-breed software.”

Learn to walk before you can run

The same applies to a new field like data analytics. Every company has ‘small data’: the structured internal data coming from ERP, WMS, CRM or HRM systems. But ‘big data’ has been the hot topic for years. This includes unstructured internal data such as e-mails, but also structured and unstructured external data such as weather information and social media posts. Artificial intelligence offers ever-more possibilities to turn that big data into meaningful information that supports better decision-making. “But again, you have to learn to walk before you can run. Don’t start working with artificial intelligence right away if your master data isn’t reliable,” said Lofvers.

Van der Drift referred to the new generation of software suppliers – the equivalent of Tesla in the car industry – who are now also offering functionality for analysing unstructured data. “For the first time, it’s now possible to generate real value with this. That makes it an interesting proposition; we now not only have the data, but also the tools to expand our existing datasets with structured data,” he stated.

Under the bonnet

Van der Drift mentioned two trends that companies should take into account irrespective of their strategy. The first trend relates to the huge strides that classic S&OP software vendors have made in recent years, including in flexibility and usability: “This has resulted in new capabilities that were unthinkable just a few years ago, such as scenario planning and the aggregation and disaggregation of data. There’s a completely different engine under the bonnet than before.”

Secondly, in the case of more and more software, when you lift the bonnet all you see is a black box – just like in a Tesla. “Such systems use artificial intelligence and machine learning, for example, to analyse unstructured data, or offer access to external datasets. It’s an interesting trend that will undoubtedly accelerate. These systems are opening up a completely new world of solutions.”

The vendor’s DNA

Van der Drift named vendors such as O9 and Aera Technology, who appear to be ahead of their time. “But in some ways they don’t seem mature yet,” he added. “Their websites look like an old-fashioned ad by a German car manufacturer. The focus is on technology rather than on how to harness that technology or how to benefit from it. They feel compelled to explain what sets them apart from the rest and what they do, not why they do it. That makes it difficult for many companies to figure out whether they should consider these vendors.”

Making the right choice requires more than just a functionality assessment; in recent years, other factors have become more important too. For Van der Drift himself, the software vendor’s DNA plays a key role: “What’s their background? What’s their track record in your sector? Nowadays, all vendors offer the same basic functionality. But which vendor will be the perfect match for you increasingly depends on their DNA. Businesses often underestimate that.”