IT Subway Map Europe 2024: Economic uncertainty dampens supply chain software growth

The heady growth in supply chain software of the past two years seems to be tempered this year by the global economic uncertainty. Due to continued high volatility in customer demand, manufacturing companies and retailers still have the most the need for forecasting and demand planning software to increase their resilience. Demand for transport management systems (TMS) scores equally highly, according to supply chain software vendors, prompted by the many disruptions worldwide that continue to hit logistics chains today. Lastly, Supply Chain Movement’s annual survey for the SCM IT Subway Map Europe clearly shows that software vendors are increasingly forming alliances with each other to serve customers jointly.

By Martijn Lofvers

Demand for supply chain software in Europe persists, but is slightly weaker than a year ago. Of the 45 supply chain software vendors with offices in Europe surveyed, 40 answered in the magazine’s survey that their sales increased last year compared to 2022; for the remaining five, it remained stable. 60% of respondents saw more implementations in 2023, and the rest a similar number. Almost two-thirds saw the number of employees increase again; at 11%, staff numbers decreased. Software vendors say they use generative AI (GenAI) mainly internally and less so in their applications.

The hype around GenAI is at its peak right now, including in the supply chain. According to US analyst firm Gartner, half of supply chain leaders plan to implement GenAI this year; 14% are already in the implementation phase. According to Gartner, companies with the best-performing supply chains are investing twice as much in artificial intelligence (AI) and machine learning (ML) as their competitors to optimize their processes at a rapid pace. The application of AI in demand forecasting scores highest among these high performers at 40%, while only 19% of lower performers are applying it.

Acquisitions in Europe

Due to the strong need for intelligent software for forecasting and demand planning, Logility, one of the largest vendors, acquired Garvis last autumn. This Belgian scale-up offers a forecasting and demand sensing solution with machine learning for recognizing demand patterns with, in addition, a kind of built-in chatbot that answers untrained users’ planning questions. Incidentally, a year ago Logility acquired Starboard, a digital supply chain twin for calculating the optimal supplier network based on cost and CO2 emissions. In the same vein, Blue Yonder, formerly known as JDA, recently announced the acquisition of One Network.

A few months previously, Blue Yonder acquired German production and transport planning software provider Flexis. Similarly, Finnish player Relex Solutions acquired production planning specialist Optimity from Sweden. Besides the various acquisitions, numerous supply chain software vendors have entered into alliances with players that complement their offering, mainly because of the market need for functionality in the areas of visibility and sustainability.

The major German software vendor AEB has partnered with Hamburg-based start-up Gryn, which provides visibility into the carbon footprint of companies. Network design and optimization specialist Aimms and BigMile are working together to calculate and minimize actual carbon emissions for their customers. Due to the need for European publicly listed companies to record and audit carbon emissions under CSRD guidelines, accountancy firm KPMG has announced a strategic partnership with French software provider Sweep to accelerate corporate sustainability.

Both FourKites and Shippeo, competitors in real-time transport visibility, have partnered up with BuyCo to provide an end-to-end ocean freight management solution. Earlier this year, FourKites also announced a partnership with John Galt Solutions, specialist in Sales & Operations Planning (S&OP) to deliver end-to-end supply chain visibility to customers. FourKites’ major US competitor, Project44, has partnered with German business process mining specialist Celonis for the same purpose.

Meanwhile, o9 Solutions, a supplier of AI software platforms, has partnered with Resilinc, a specialist in supply chain risk management. This partnership enables companies to monitor their n-tier supplier network, to assess disruptions and to minimize their impact by using alternative supply chains.

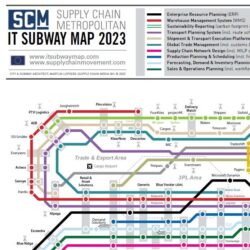

Get the SCM IT Subway Map 2024

All these acquisitions, as well as map newcomers Carbmee, Caroz, EPG, Optilogic, Pelico, Planisense, Uber Freight and Winddle, have been incorporated into the fourteenth edition of the SCM IT Subway Map Europe. Based on input from software vendors – including their number of live customers in Europe and the percentage of sales by software type – in combination with our own research, our editors have assigned them a number of subway stations indicating their proven expertise in Europe.

In addition to the SCM IT Subway Map in our magazine and on the enclosed poster, Supply Chain Media has developed this interactive online version showing the European software market: www.itsubwaymap.com.