Supply chain disruption has increased costs and complexity for big businesses

Two thirds (66%) of large enterprises globally are holding more inventory now than in the pre-pandemic period. In fact, one in five companies (18%) are holding ‘significantly more’ stock. Companies’ increasing focus on taking innovative action to address supply chain disruption is highlighted in a new large-scale survey commissioned by software vendor IFS.

More than 1,450 decision-makers from companies in France, Germany, Scandinavia, the USA, the UK and the United Arab Emirates completed the survey. Seven out of ten respondents (70%) say that they have increased the number of suppliers of materials/products they use in response to recent supply chain issues. In addition, nearly three quarters (72%) of respondents claim that they are sourcing more materials/products from domestic suppliers as a result of these issues.

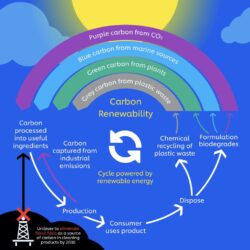

These additional measures are likely to create more complexity within the supply chain. This comes at a time when the regulatory burden is already increasing (cited by 15% as a primary contributor to their current business disruption) and there is a growing need to leverage the many benefits of the circular economy. On a positive note, 93% of respondents say their company is either embracing the circular economy or plans to do so in the future. However, many respondents indicate that they are facing challenges in terms of delivering on their goals.

Reducing the risk of supply chain disruption

The survey reveals that many large enterprises have already adapted their supply chains in innovative ways to reduce the risk of disruption. These include opting for onshoring to improve security of supply, holding more stock to ensure they can always meet demand, and increasing the number of suppliers they use to avoid having to disappoint customers.

“Large businesses are likely to incur much higher costs and other negative financial impacts because of the measures they are taking to mitigate disruption. Onshoring the supply chain will often lead to having to invest in more expensive raw materials or product components, especially as inflation ramps up, while keeping stock on hand will tie up significant sums that could otherwise be ‘working’ for the business,” comments Maggie Slowik, Global Industry Director for Manufacturing at IFS.

Talent shortage

The survey also shows that many large businesses are suffering from a shortage of talent. 65% of respondents say that their organization is finding it difficult to fill vacancies, with a lack of qualified applicants and a lack of skilled talent being the most common reasons for this. Furthermore, 39% expect that disruption related to the skills shortage within their organization will last beyond the end of 2022.

Slowik adds: “Businesses urgently need to find a solution that can help them to manage this disruption which with price volatility is escalating ever further, transition to a circular economy, and address the supply chain complexities we are dealing with today. To do this, especially when skills are in short supply, they will ultimately need to invest in technology that delivers the agility and fast time to insight that they need to better forecast demand.”