Manufacturers are relying on their inventories again in the face of supply chain bottlenecks

Supply chain bottlenecks are testing European manufacturing companies to their limits on a daily basis, and the situation has worsened significantly over the past year. These conclusions come from an international survey by the German firm Reichelt Elektronik among 1,550 industrial companies, 250 of which are based in the Netherlands. In a previous survey in June 2021, more than 60% of the manufacturing companies surveyed were still optimistic about an improvement in supply chain bottlenecks in the next 12 months. But according to a new version of the survey early this year, less than half are now confident about the future. Businesses are being forced to change their strategies, and many of them are increasing their stock.

In the ‘Bottlenecks in the Supply Chain’ survey, which was conducted by the international research institute OnePoll, 85% of respondents said that supply chain bottlenecks have had a major impact on their business over the past year, in some cases bringing production to a complete standstill. Whereas bottlenecks interrupted production for an average of 38 days according to the survey in June 2021, this figure had risen to 47 days just over six months later. According to the researchers, this increase means that many companies will have to rethink their strategies. When delivery problems arise, the just-in-time approach that has traditionally enabled inventories to be kept to a minimum is no longer sufficient. In practice, this means that many businesses are currently increasing their stocks. In the latest survey, 64% of all respondents indicated that they are doing so “significantly”, compared to 49% in June 2021.

Local production

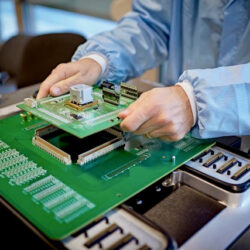

Although the scarcity of raw materials was regarded as somewhat problematic by 38% in June 2021, it seems that the situation has improved over the past few months. Now, only 27% see this as a significant company risk, and analysis of the responses by Dutch companies implies that they are not overly worried about potential problems in the next two years. Manufacturers are most concerned that they will experience problems due to bottlenecks in the supply of critical components such as microelectronics (34%). They also fear rising energy prices (30%) and inflation (28%). Only a quarter of respondents say that they are worried about a shortage of skilled labour, so this is certainly no longer the top concern among manufacturers.

According to the survey by Reichelt, which is one of Europe’s largest online distributors of electronics and IT technology, this underlines the Dutch manufacturing industry’s limited dependence on the supply of particular products. In order to remain independent in the future, more than half of the companies say they have now once again started to manufacture certain products themselves that they previously sourced. A further 43% intend to start producing certain products themselves again soon, and only 6% say they have no such plans as yet.

Semiconductors

However, not all products can be produced easily in-house. Semiconductors are just one example. Therefore, for Dutch companies, European facilities can be an attractive way of improving the supply situation. For this, more factories would need to be built in Europe, although even then the question remains whether European-made semiconductors could continue to match ones made in the Far East in terms of price.

When asked which criteria European semiconductor manufacturers would need to meet in order for companies to buy their products despite higher prices, the respondents ranked guaranteed and respected security of supply as most important. Other decisive factors were minimal price difference (50%), long-term price stability (36%) and a better environmental balance than the competition (32%).

Future technologies

So as not to fall behind the global market for future technologies, such as semiconductor manufacturing, 36% of companies now want governments to provide more support for local research into future technologies and the production of essential components, compared with only 27% in June 2021. This shows that numerous companies have changed their minds about the importance of independence over the past few months.

In the case of all innovative alternatives, it remains to be seen whether the changes will be sustained after the pandemic. 70% think companies will return to a just-in-time approach for most parts after the crisis, while 19% think this will happen for all parts. Only 9% believe that just-in-time is a thing of the past.